Here are the best mutual funds for SIP in India in 2020

Here are the best SIP mutual funds to invest in India in 2020

We list down the best mutual funds in each category.

Here are the best SIP mutual funds to invest in India in 2020

We list down the best mutual funds in each category.

| Scheme type | Scheme name |

|---|---|

| Equity Large Cap | Mirae Asset Large Cap Fund |

| Equity Mutli Cap | Axis Multi Fund |

| Equity Mid Cap | Axis Mid Cap Fund |

| Equity Small Cap | HDFC Small Cap Fund |

| Equity Large & Mid Cap | Mirae Emerging Blue chip Fund |

| ELSS | Mirae Asset Tax Saver Fund |

| Scheme name and type |

|---|

| Mirae Asset Large Cap Fund (Equity Large Cap) |

| Axis Multi Cap Fund (Equity Multi Cap) |

| Axis Mid Cap Fund (Equity Mid Cap) |

| HDFC Small Cap (Equity Small Cap) |

| Mirae Emerging Bluechip Fund (Equity Large & Mid Cap) |

| Miare Asset Tax Saver Fund (ELSS) |

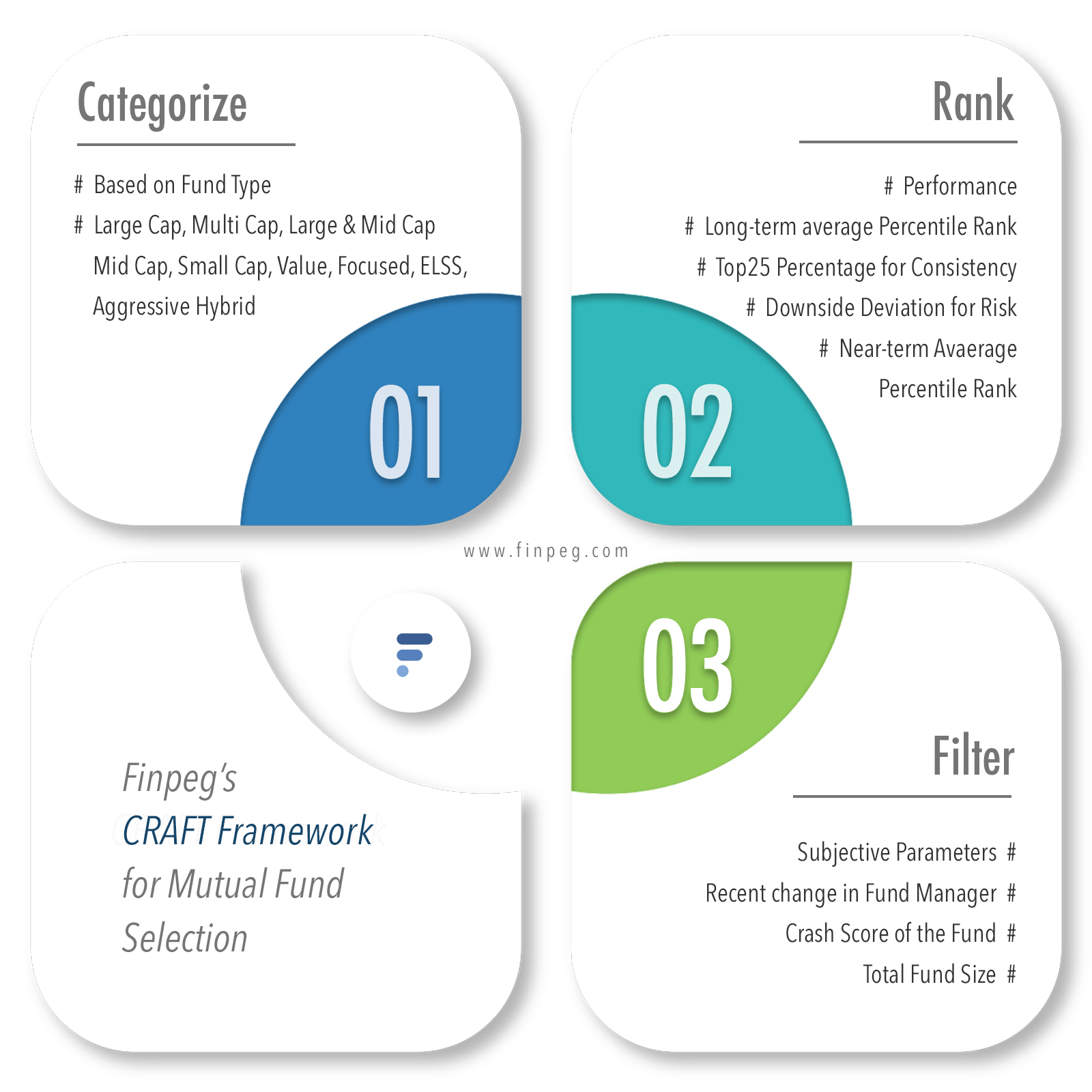

Finpeg's cutting-edge CRAFT Framework to pick the best SIP Mutual Funds

A comprehensive rank-based framework that uses past 20 years of data to pick out the best mutual funds.

Finpeg's cutting-edge CRAFT Framework to pick the best SIP Mutual Funds

A comprehensive rank-based framework that uses past 20 years of data to pick out the best mutual funds.

Categorize, based on Fund Type

The first step is to categorize the funds into different categories based on their type. For example, large cap is one such category. The main idea here is that you want to compare funds within a category and NOT across categories. Something on the lines of making apple-to-apple comparison.

Rank, based on Fund Performance

Once we have the categories, the next step is to rank the funds within each category. Ranking should be done for funds within a category and NOT across categories. The guiding philosophy that this framework follows can be summed up in a single sentence – “Long-term track record of consistent performance”.

Filter, based on qualitative assessment

And finally, once we have ranked the funds, we should filter funds based on qualitative assessment. Qualitative factors include any recent change in fund manager, total size of the fund and performance of the fund during times of steep market crash. More details on the framework here.

Best Mutual Funds for SIP may not necessarily be your best bet

SIPs, although a great way to invest, are not necessarily the best or the most optimal way to invest in mutual funds.

Best Mutual Funds for SIP may not necessarily be your best bet

SIPs, although a great way to invest, are not necessarily the best or the most optimal way to invest in mutual funds.

SIPs invest every monthly instalment in equity mutual funds. But cost averaging can work both ways. You don't just catch falling markets.

Throughout the lifetime of your SIP, you stay invested in equity mutual funds without applying any intelligent tactical rebalancing.

What happens when a fund starts under performing? SIPs do not give you an option to optimize - remove the under performers from your portfolio.

SIPs do not have an exit strategy. What happens when you want your money back and the markets are at an all time low? You wait or redeem?

Even with best Mutual Funds, SIPs can end up with negative returns?

Even with best Mutual Funds, SIPs can end up with negative returns?

Introducing AlphaSIP. The smartest way to do SIPs in mutual funds

Using advanced investing algorithms, AlphaSIP offers a far better alternative to regular SIPs.

Introducing AlphaSIP. The smartest way to do SIPs in mutual funds

Using advanced investing algorithms, AlphaSIP offers a far better alternative to regular SIPs.

AlphaSIP delivers a tangible alpha over your regular SIPs. Using various inputs like PE ratio, PB ratio, Interest Rates, we have trained our algorithm to decide the most optimal asset allocation at any given point of time.

Be it a generic NIFTY Index or a portfolio of actively managed funds, AlphaSIP has consitently generated 3% - 5% alpha over regular SIPs. Along with the alpha, AlphaSIP offers phenomenal risk reduction.

Instead of picking funds on an ad-hoc basis, we give you a portfolio of best mutual funds using an extensively researched and time-tested framework.

Best mutual funds today may not be the best 3 years down the line. We make sure that your portfolio is reviewed and optimized so that you are always invested in the best mutual funds.