Investing in mutual funds online is as simple and easy as buying a t-shirt online

Step 1: Be sure that investing in mutual funds is the best option available

When you set out to buy a t-shirt, you have already assessed whether t-shirt fits your requirement. Same thing needs to be done for your investments.

The first step towards investing in any asset is to identify your financial goals. Unless you don't have clearly defined financial goals, you will never be able to identify the right instrument to invest in.

You can have multiple financial goals such as buying a house in 10 years or child's college education in 20 years or building a retirement corpus. Learn more about financial goals in our blog how to define financial goals and achieve them.

Once you have identified your financial goals, you need to evaluate whether mutual funds are the right instrument to achieve those goals. There are number of other investment options like real estate, gold, direct equities, bank FD and so on.

For that matter, there are different types of mutual funds as well that can help you reach different goals. So essentially, you will have to map each of your investment goals with the investment instruments that will help you reach that goal.

Step 2: Choosing an online mutual fund transaction platform and/or advisor

Step 2: Choosing an online mutual fund transaction platform and/or advisor

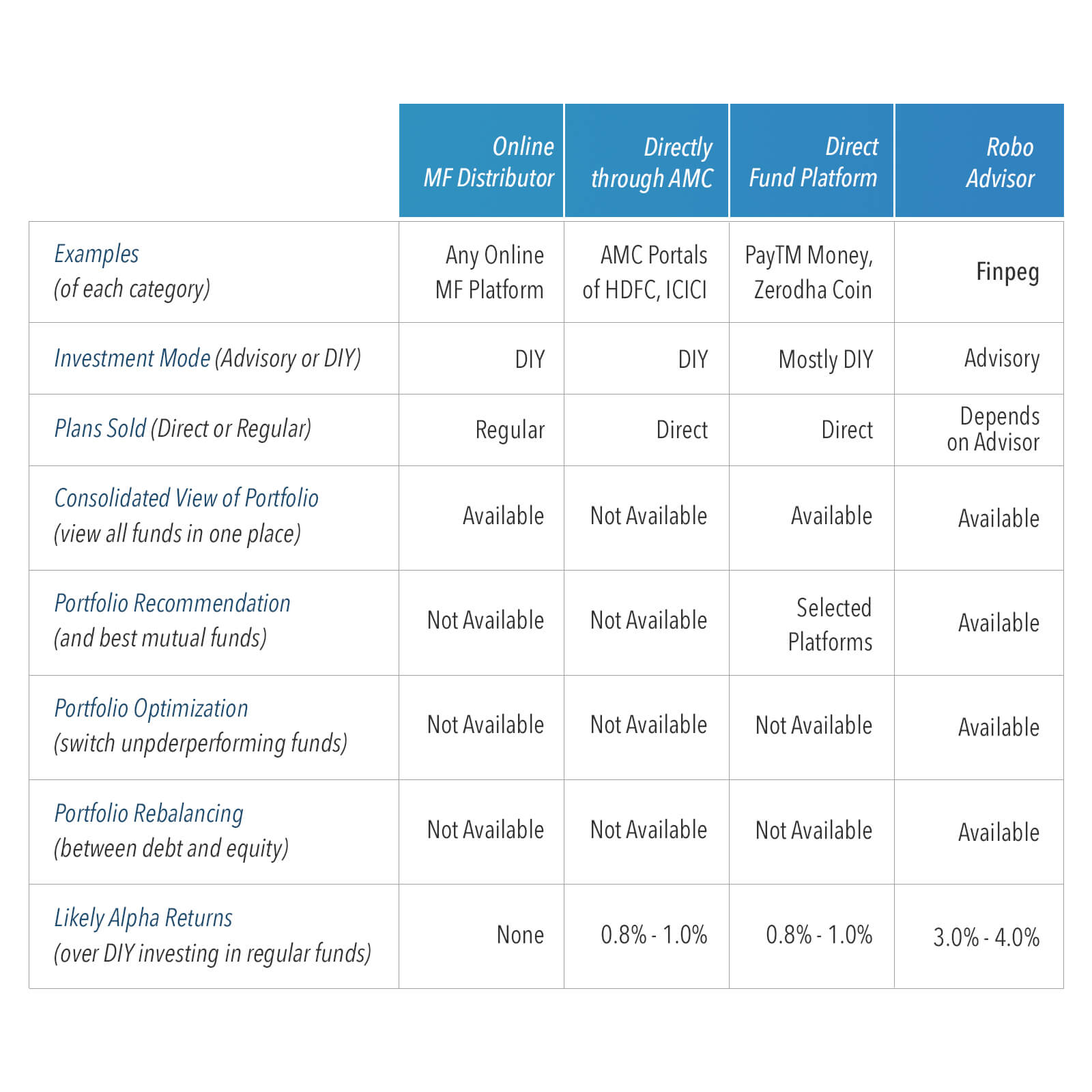

The second obvious step is to select an online platform where you can start investing in mutual funds. There are number of options available.

There are many platforms that allow you to set up an SIP or invest lump sum online. Not all of them are robo advisors.

For an online platform to be a "robo advisor" in true sense, it should take care of every aspect of investment once you start with them. This includes portfolio creation, portfolio optimization, rebalancing and exit.

Plus, a good robo advisor should offer intelligent investment solutions that deliver extra returns than your DIY SIPs and lump sums.

If you don't plan to engage an advisor for investing in mutual funds online, you should always go for platforms that offer direct mutual funds. This way, you ensure that you earn 0.8% - 1.0% extra returns over regular mutual funds.

Unless your advisor doesn't offer a superior investing methodology, regular funds are not worth it. However, if you feel that your advisor has solutions that will enable you to even outperform direct funds, go with a regular fund advisor.

Step 3: Build your portfolio, invest and keep reviewing

Step 3: Build your portfolio, invest and keep reviewing

This is the third, final and the most complicated step. Once you have identified your financial goals, you will have to create a plan on how to reach them.

Your financial goals, the amount you can invest and the portfolio you invest in should all be in sync.

Suppose you need ₹ 50 lac for a house in 10 years time. You can invest only ₹ 10,000 per month. If you choose a portfolio with an expected return of 15%, you will end up with only ₹ 27.5 lac in 10 years time.

What are your options?

- You can decrease your target goal amount

- Or, you can increase your montly SIPs to roughly ₹ 18,000

- Or, you can decide to increase your SIP amount by 15% every year

- Or, you can opt for a more aggreassive portfolio (also a more risky one)

For figuring out these numbers, we have a couple of useful tools - SIP Calculator and Lump sum Calculator. And if your financial goal is to build a retirement corpus, we have an amazing Retirement Planner.

Once you are ready with your goals and portfolios, it's time to start investing.

Whatever platform you select, the logistics of getting started are pretty simple. The steps are as follows:

- Get your KYC done if not already in place. Your advisor should help out with this process

- Create an account with the online platform you have selected

- If you want to invest via SIPs, you will need to register a NACH mandate or a biller. Again, your advisor should help out with this process

- That's it! You can now start investing

You should also keep reviewing your portfolio to keep a tab on underperforming mutual funds as well as your goals.

You should remove underperforming mutual fund and switch to a new fund. Also, you have to make sure that your asset allocation does not go for a complete toss.

At Finpeg, we take care of all the above steps for you and much more

At Finpeg, we take care of all the above steps for you and much more

For someone new to mutual funds, starting online can appear to be a huge task. But don't worry. We take care of your entire investing journey. And there is a dedicated relationship manager by your side.

And it doesn't end there. Our cutting-edge research and intelligent investment solutions provide 3% - 4% extra returns than a regular SIP or lump sum investment.

SIPs are a great way to invest in mutual funds but NOT the best way.

Using intelligent asset allocation and portfolio optimization techniques, AlphaSIP offers much better returns than your plain SIP investments.

Be it a generic NIFTY Index or a portfolio of actively managed funds, AlphaSIP has consitently generated 3% - 5% alpha over regular SIPs. Learn more about AlphaSIP.

Investing lump sum amount into equity mutual fund is a risky bet. You don't know how markets will play out and how to time your entry.

Finpeg Lump Sum strategy uses intelligent asset allocation and portfolio optimization techniques to deliver 3% - 5% alpha over plain lump sum investments. Plus, a phenomenal risk reduction. Learn more about Finpeg Lump Sum Strategy.